PhiladelphiaŌĆÖs 2024 Budget: Tax Relief Prioritized Over Education Investment

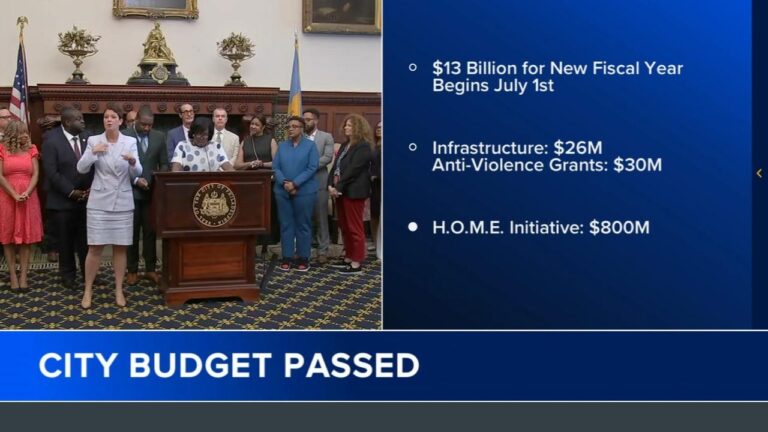

PhiladelphiaŌĆÖs newly ratified budget for 2024 introduces tax reductions aimed at alleviating financial pressures on residents and local businesses. While these cuts are designed to stimulate economic growth and provide immediate relief, the allocation for public education sees only a marginal increase, sparking debate among educators and community advocates. Despite persistent demands for enhanced funding to improve school infrastructure, raise teacher salaries, and expand student support services, the budgetŌĆÖs modest boost in education spending falls short of expectations.

Key elements of the budget include:

- Property tax reduction: A 3% decrease intended to lessen the financial load on homeowners.

- Incremental school funding: A 2% increase, significantly below the 5-7% rise sought by education stakeholders.

- Infrastructure maintenance: Slightly increased funding, though still insufficient to address urgent facility repairs.

| Category | Previous Budget | Current Budget | Percentage Change |

|---|---|---|---|

| Property Taxes | $1.2B | $1.16B | -3% |

| Education Funding | $900M | $918M | +2% |

| School Infrastructure | $150M | $155M | +3.3% |

While fiscal conservatives applaud the tax relief measures, education leaders caution that these incremental increases in school funding are unlikely to resolve deep-rooted challenges such as aging facilities, teacher shortages, and insufficient student resources. The tension between fostering economic vitality and investing in education remains a central issue as Philadelphia navigates its fiscal priorities.

Analyzing the Gap Between Tax Cuts and Education Budget Growth

The 2024 budget reveals a significant disparity between the scale of tax reductions and the modest rise in education funding. Despite promises to enhance PhiladelphiaŌĆÖs public schools, the funding increase barely keeps pace with inflation, leaving critical areas like classroom modernization and teacher compensation underfunded. Community leaders warn that prioritizing tax relief over education investment risks undermining efforts to close achievement gaps and improve student outcomes.

Financial analysts highlight this imbalance by comparing the changes in tax revenue and school funding allocations:

| Category | Previous Year ($M) | Current Year ($M) | Change (%) |

|---|---|---|---|

| Tax Revenue | $1,200 | $1,140 | -5% |

| Education Budget | $560 | $570 | +1.8% |

Critics argue this funding approach favors short-term fiscal relief at the expense of sustainable educational progress. Advocates urge city officials to revisit budget priorities to ensure that tax cuts do not compromise the quality and equity of PhiladelphiaŌĆÖs public education system.

Community Feedback on Education Funding and Tax Relief

The budget announcement has elicited strong reactions from parents, teachers, and advocacy organizations who feel the modest increase in school funding fails to meet the cityŌĆÖs growing educational demands. Many express frustration that despite PhiladelphiaŌĆÖs expanding tax base, investments in public schools remain stagnant, leaving issues like overcrowded classrooms, outdated learning materials, and insufficient mental health services unaddressed. ŌĆ£This budget misses the mark on supporting our childrenŌĆÖs future,ŌĆØ remarked a local PTA president, underscoring the challenges educators face without adequate resources.

Public forums and social media discussions have become platforms for calls to reallocate funds toward critical educational priorities. Community members emphasize the need for:

- Modernized classroom technology to support digital learning initiatives

- Expanded after-school and enrichment programs to foster student development

- Improved recruitment and retention strategies for qualified teachers

- Enhanced accessibility and support for students with disabilities

| Group | Primary Concern | Requested Action |

|---|---|---|

| Philadelphia Parents Association | Reducing class sizes | Increase per-pupil funding |

| EducatorsŌĆÖ Union | Competitive teacher salaries | Raise pay and benefits to retain staff |

| Mental Health Advocates | Expanded counseling services | Hire additional mental health professionals |

Strategies for Aligning Tax Relief with Education Investment

To reconcile the need for tax relief with the imperative of adequately funding schools, policymakers should adopt a phased strategy that targets resources toward the most underfunded schools while implementing gradual tax reductions. Focused investments in teacher compensation, classroom resources, and extracurricular programs can yield measurable improvements in student achievement without necessitating broad tax increases. Transparent budgeting processes will also enhance accountability and ensure funds are directed to priority areas.

A balanced fiscal approach might include moderate tax breaks for small businesses and low-income households, paired with dedicated revenue streams earmarked for education. For instance, creating a Philadelphia Education Trust Fund financed through selective leviesŌĆösuch as a surtax on luxury properties or increased commercial property taxesŌĆöcould provide a reliable funding source for schools. Below is a conceptual framework illustrating this balance:

| Fiscal Policy | Tax Effect | Education Funding Effect |

|---|---|---|

| Small Business Tax Credit | -10% | Minimal net impact, offset by economic growth |

| Luxury Property Surtax | +5% on top 5% of properties | +15% dedicated to education |

| Commercial Property Tax Adjustment | +3% | +10% for school infrastructure |

Conclusion: PhiladelphiaŌĆÖs Budget and the Future of Education Investment

As Philadelphia embarks on a budget cycle that reduces tax burdens while only marginally increasing school funding, the long-term consequences for the cityŌĆÖs education system remain uncertain. Although taxpayers may appreciate the immediate financial relief, education advocates stress the urgency of more robust investments to tackle persistent challenges in public schools. The months ahead will be pivotal in shaping how these fiscal decisions influence the quality of education and the broader well-being of PhiladelphiaŌĆÖs communities.