PhiladelphiaŌĆÖs Business Tax Reduction Plan: A Risky Gamble for City Finances

Assessing the MayorŌĆÖs Proposal to Cut Business Taxes

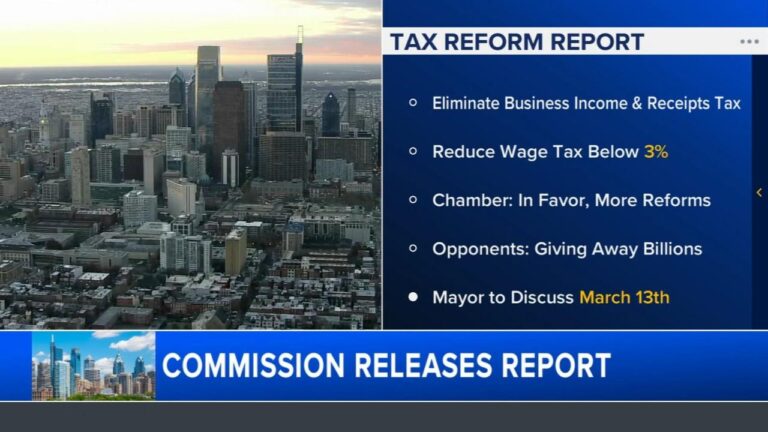

PhiladelphiaŌĆÖs mayor has recently introduced a plan aimed at lowering business taxes with the goal of invigorating the local economy. While the intention to boost economic activity is commendable, this strategy raises serious concerns regarding the cityŌĆÖs fiscal health. Reducing business tax rates threatens to disrupt PhiladelphiaŌĆÖs critical revenue base, which funds indispensable public services such as education, public safety, and infrastructure upkeep. Without stable and sufficient income, the city may face growing budget shortfalls, potentially leading to cuts in essential programs or increased borrowing that could jeopardize long-term financial sustainability.

Examining the projected financial impact reveals a significant decline in revenue. Estimates suggest an annual shortfall reaching hundreds of millions of dollars, which would disproportionately affect community initiatives and municipal operations. It is also important to note that the link between business tax cuts and job creation is tenuous, especially in complex urban economies like PhiladelphiaŌĆÖs, where multiple factors influence growth. The table below compares current business tax revenues with anticipated figures following the proposed cuts:

| Fiscal Year | Current Business Tax Revenue (in $ millions) | Estimated Revenue After Tax Reduction (in $ millions) |

|---|---|---|

| 2024 | 850 | 650 |

| 2025 | 870 | 670 |

| 2026 | 890 | 690 |

- Lowered revenues could delay or cancel critical city projects.

- Increased borrowing may be necessary, raising future financial burdens.

- Assumptions about tax cuts driving sustained economic growth remain unproven.

Economic Implications for PhiladelphiaŌĆÖs Public Services

Comprehensive economic assessments indicate that the proposed business tax reductions could severely curtail PhiladelphiaŌĆÖs funding for vital public services. The city relies heavily on these revenues to support education, emergency services, and infrastructure maintenance. A projected annual revenue loss of approximately $150 million would exacerbate existing budgetary pressures, forcing difficult choices between service cuts and alternative revenue generation methods that might disproportionately impact vulnerable populations.

Potential consequences of this funding gap include:

- Staff layoffs and resource constraints in public schools

- Postponement of essential infrastructure repairs and upgrades

- Heightened strain on emergency response and public health systems

| Public Service Sector | Estimated Funding Reduction |

|---|---|

| Education | $60 million |

| Public Safety | $45 million |

| Infrastructure | $45 million |

Experts caution that while proponents highlight short-term benefits, the long-term repercussions could be detrimental. Diminished public services may lower quality of life and deter both new businesses and residents, ultimately undermining PhiladelphiaŌĆÖs economic competitiveness and social equity.

Why Targeted Incentives Outperform Broad Tax Cuts

Fiscal analysts argue that sweeping tax reductions for all businesses often produce unintended negative effects, including reduced funding for essential city services. Instead, they recommend implementing targeted incentives that focus on sectors with strong potential for job creation and innovation. This strategy enables Philadelphia to nurture economic growth while preserving the revenue necessary to maintain public infrastructure and services.

Research shows that broad tax cuts tend to disproportionately benefit large corporations, whereas targeted incentives can deliver higher returns by supporting small and medium-sized enterprises, green technologies, and workforce development programs. The following table contrasts the advantages and drawbacks of these two approaches:

| Tax Strategy | Benefits | Drawbacks |

|---|---|---|

| Broad Tax Cuts | Quick financial relief Easy to implement | Reduces city revenue Favors large corporations disproportionately |

| Targeted Incentives | Encourages job growth Supports emerging industries and innovation | Requires careful oversight Longer timeframe to see results |

Strategic Recommendations for Sustainable Fiscal Policy

Experts agree that PhiladelphiaŌĆÖs tax policy must balance economic stimulation with fiscal responsibility. Abrupt, broad tax cuts without strategic planning risk destabilizing the cityŌĆÖs finances and undermining public services. Instead, a measured and balanced approach is essentialŌĆöone that aligns tax policy with the cityŌĆÖs broader economic and social goals.

Key recommendations include:

- Thorough Cost-Benefit Analysis: Evaluate the fiscal impact of tax changes to safeguard budget stability.

- Focused Incentives: Prioritize relief for small and mid-sized businesses to maximize economic benefits.

- Phased Implementation: Introduce changes gradually to monitor effects and adjust policies accordingly.

- Transparency and Accountability: Provide clear reporting on how business tax revenues support community programs and infrastructure.

| Policy Component | Expected Result |

|---|---|

| Balanced Tax Adjustments | Stable and predictable revenue streams |

| Targeted Small Business Support | Enhanced local entrepreneurship and job creation |

| Incremental Rollout | Ongoing fiscal health monitoring |

| Transparency Measures | Greater public trust and engagement |

Final Thoughts

PhiladelphiaŌĆÖs mayoral proposal to reduce business taxes presents a complex challenge. While aiming to foster economic growth, the plan risks significant revenue losses that could jeopardize the cityŌĆÖs financial stability and the quality of essential public services. Independent analyses, including those from the Institute on Taxation and Economic Policy, highlight the need for caution and strategic planning. Policymakers must carefully evaluate the long-term consequences to ensure PhiladelphiaŌĆÖs fiscal health and community well-being are preserved while pursuing sustainable economic development.