The City of Philadelphia has officially launched the Small Business Catalyst Fund, a new initiative aimed at providing critical financial support to local entrepreneurs and small businesses. This fund is designed to help stimulate economic growth, create jobs, and foster resilience in neighborhoods across the city. With grants and resources tailored to meet the unique challenges faced by small business owners, the Philadelphia Small Business Catalyst Fund represents a significant commitment by city officials to bolster the local economy and empower community-driven development.

City Unveils Small Business Catalyst Fund to Boost Local Economy

In a strategic move to invigorate local commerce, the City of Philadelphia has introduced the Small Business Catalyst Fund, designed to provide critical financial support to emerging and existing small enterprises. This initiative aims to stimulate economic growth by offering grants and low-interest loans tailored to businesses that demonstrate innovation and community impact. Priority will be given to ventures in underserved neighborhoods, ensuring equitable access to resources and fostering a more inclusive economic environment.

Key features of the fund include:

- Grants up to $50,000 for startups focusing on sustainability and tech integration.

- Zero-interest loans with flexible repayment terms for established small businesses.

- Business mentorship programs offered alongside financial aid to enhance operational success.

| Fund Component | Eligibility | Benefit |

|---|---|---|

| Startup Grants | Businesses under 2 years old | Up to $50,000 |

| Growth Loans | Businesses 2+ years old | Zero-interest, flexible terms |

| Mentorship Access | All applicants | Professional business coaching |

Key Eligibility Criteria and Application Process for Philadelphia Entrepreneurs

Entrepreneurs seeking to benefit from the Philadelphia Small Business Catalyst Fund must meet specific eligibility requirements designed to support local, emerging businesses. Applicants should have a registered business operating within Philadelphia city limits, with a focus on small to medium enterprises. Priority is given to businesses demonstrating innovation, community impact, and potential for growth. Additionally, eligible applicants must have been in operation for at least six months and provide evidence of financial stability, such as tax returns or bank statements. Nonprofits and sole proprietors with a clear business plan are also encouraged to apply, provided they meet the fund’s mission criteria.

The application process is streamlined and transparent, aiming to facilitate quick access to funds. Entrepreneurs can submit their applications through the City of Philadelphia’s official grants portal, where they will be guided through an easy-to-navigate questionnaire. Required documentation includes the business plan, proof of Philadelphia residency or business address, financial statements, and an outline of how funds will be utilized. The review period typically lasts 30 to 45 days, with selected businesses invited for an interview or presentation. For convenience, applications can be saved and resumed later, and support is available via a dedicated helpline for assistance throughout the process.

Targeted Support for Minority and Women-Owned Small Businesses

Recognizing the unique challenges faced by minority and women entrepreneurs, the city has allocated a significant portion of the Small Business Catalyst Fund exclusively to businesses owned by these groups. This initiative aims to reduce financial barriers, provide equitable growth opportunities, and foster a more inclusive business community across Philadelphia. Eligible businesses can access grants, low-interest loans, and advisory services tailored to their specific needs, ensuring a comprehensive support system from startup through expansion phases.

The program highlights several key support features:

- Dedicated funding pools: Special grant allocations for minority and women-owned small enterprises.

- One-on-one mentorship: Partnering awardees with experienced business advisors.

- Networking opportunities: Access to exclusive events designed to build industry connections.

| Support Component | Benefit | Eligibility |

|---|---|---|

| Financial Grant | Up to $25,000 for capital expenses | Certified minority or women-owned business |

| Business Coaching | Monthly sessions for 6 months | All applicants receiving funding |

| Networking Access | Invitation to quarterly industry mixer | Fund recipients |

Expert Tips for Maximizing Benefits from the New City Fund

To fully leverage the opportunities provided by the Philadelphia Small Business Catalyst Fund, businesses should prioritize clear and detailed proposal submissions. Emphasizing how your business aligns with the fund’s mission to accelerate growth in underrepresented sectors can significantly increase funding prospects. Also, photograph or document your operations and community impact—they serve as compelling evidence of your eligibility and commitment.

Key strategies include:

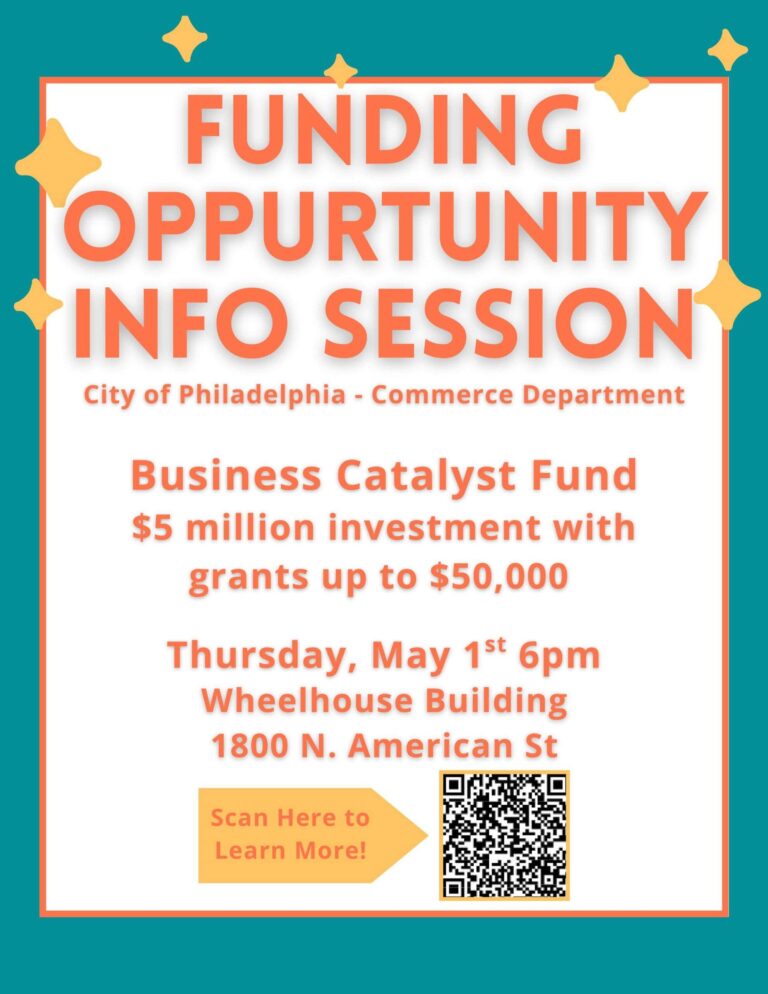

- Networking with City Representatives: Attend workshops and informational webinars often hosted by Philadelphia’s economic development departments to raise your profile.

- Financial Record Readiness: Have your financial statements and business plans organized and up-to-date for a smooth and timely application process.

- Community Engagement: Illustrate your contribution to local employment and neighborhood revitalization for enhanced grant consideration.

| Tip | Benefit |

|---|---|

| Engage with Fund Mentors | Gain personalized guidance and increase proposal success |

| Utilize Local Resources | Access free workshops and advisory services |

| Submit Early Applications | Improve chances by avoiding last-minute errors |

In Conclusion

The launch of the Philadelphia Small Business Catalyst Fund marks a significant step forward in supporting local entrepreneurs and fostering economic growth across the city. By providing accessible financial resources, the initiative aims to empower small businesses to navigate challenges and seize new opportunities. As Philadelphia continues to prioritize equitable economic development, this fund represents a vital investment in the city’s diverse business community and its future prosperity. For more information and application details, small business owners are encouraged to visit the official City of Philadelphia website.