Philadelphia Fed’s February 2025 Survey Highlights Service Sector Resilience Amid Economic Pressures

Encouraging Signs in Service Industry Despite Rising Operational Expenses

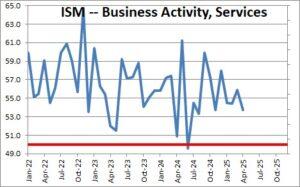

The Federal Reserve Bank of Philadelphia’s February 2025 Nonmanufacturing Business Outlook Survey reveals a cautiously optimistic mood among service sector companies in the region. Even as inflationary pressures continue to push input costs higher, many firms remain confident about expanding their workforce and increasing sales in the near term. This positive sentiment underscores the sector’s ability to adapt to economic headwinds while leveraging steady consumer demand.

- Hiring Plans: More than 60% of businesses intend to grow their employee base.

- Revenue Projections: Over half expect sales to rise in the upcoming quarter.

- Cost Challenges: Nearly 70% identify escalating expenses as a major operational concern.

| Metric | January 2025 | February 2025 | Change |

|---|---|---|---|

| Business Activity Index | 35.4 | 38.7 | +3.3 |

| Employment Index | 28.9 | 31.5 | +2.6 |

| Input Cost Index | 56.1 | 57.8 | +1.7 |

Labor Market Constraints and Pricing Pressures Challenge Service Providers

While demand remains robust, many service firms report ongoing difficulties in recruiting qualified personnel, largely due to skill shortages and intensified competition for talent. These hiring obstacles have led to delays in service delivery and increased operational expenses, affecting overall efficiency. Concurrently, businesses are carefully navigating pricing strategies to balance rising costs with customer price sensitivity.

- Recruitment Difficulties: 42% of companies cite workforce shortages as a significant barrier.

- Wage Inflation: Average wage increases reached 3.7%, reflecting tight labor market conditions.

- Price Adjustments: Nearly 58% of firms raised prices moderately over the last quarter.

| Issue | Effect | Percentage of Firms Impacted |

|---|---|---|

| Labor Shortages | Service delays | 42% |

| Wage Pressure | Increased costs | 63% |

| Price Increases | Revenue growth | 58% |

Regional Variations Highlight Uneven Growth Across Service Industries

Data from the survey indicate contrasting growth patterns across different geographic areas. The Mid-Atlantic region is experiencing accelerated expansion, particularly in finance and professional services, while the Midwest faces slower growth in sectors like transportation and warehousing. These disparities reflect localized economic conditions and broader national trends.

Industry-specific insights include:

- Technology Sector: Continues to thrive, driven by widespread adoption of digital tools and cloud services.

- Hospitality and Leisure: Recovery remains uneven, with urban centers outperforming rural areas due to stronger tourism and event activity.

- Healthcare Services: Growth is steady but moderate, constrained by workforce shortages despite ongoing demand.

| Region | Sector | Projected Growth Rate (%) |

|---|---|---|

| Mid-Atlantic | Finance & Professional Services | 4.2 |

| Midwest | Transportation & Warehousing | 1.1 |

| Southwest | Information Technology | 3.8 |

| Mountain | Leisure & Hospitality | 2.5 |

Effective Approaches for Businesses to Manage Economic Volatility in 2025

In response to the uncertain economic environment anticipated in early 2025, companies are prioritizing flexible operational strategies. Embracing adaptive budgeting and improving cash flow oversight are critical to mitigating risks from fluctuating demand. Additionally, accelerating digital transformation initiatives helps reduce costs and enhance efficiency without compromising service quality.

Industry experts recommend businesses focus on:

- Diversifying Offerings: Expanding product and service portfolios to tap into emerging market segments.

- Strengthening Supply Chains: Building resilient partnerships to prevent disruptions.

- Upskilling Employees: Investing in workforce development to boost innovation and productivity.

- Utilizing Data Analytics: Leveraging customer insights to swiftly adapt to changing preferences.

| Strategy | Expected Benefit | Timeframe for Implementation |

|---|---|---|

| Adaptive Budgeting | Enhances financial agility | 1-3 months |

| Digital Transformation | Reduces operational expenses | 6-12 months |

| Supply Chain Optimization | Ensures production stability | 3-6 months |

| Employee Upskilling | Drives innovation and efficiency | Ongoing |

Final Thoughts

The February 2025 Nonmanufacturing Business Outlook Survey from the Philadelphia Fed offers a vital snapshot of the service sector’s current state and future prospects. As companies confront a challenging economic backdrop, the survey’s findings provide valuable guidance for policymakers, investors, and business leaders. While obstacles such as labor shortages and cost pressures remain, the sector’s resilience and adaptability signal promising opportunities for growth. Ongoing analysis of these trends will be essential to understanding the broader economic trajectory in the months ahead.