Revitalizing Philadelphia’s Department of Revenue: Addressing Systemic Challenges and Restoring Public Confidence

Operational Inefficiencies Eroding Trust in Philadelphia’s Revenue Department

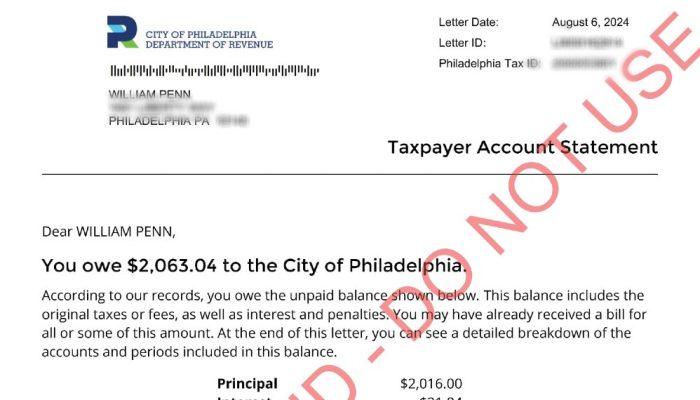

The Philadelphia Department of Revenue, responsible for overseeing the city’s fiscal management and tax collection, has been increasingly criticized for persistent operational failures. Residents and businesses alike are encountering frequent delays, inconsistent communication, and a lack of transparency that fuels dissatisfaction and mistrust. Essential functions such as tax billing and processing are often riddled with errors, resulting in unnecessary financial strain for taxpayers and complicating the city’s revenue collection efforts.

Several core issues contribute to these ongoing problems:

- Antiquated technology infrastructure that cannot efficiently handle routine tasks, leading to frequent data inaccuracies.

- Inadequate employee training which hampers effective customer service and enforcement of tax regulations.

- Deficient crisis response protocols that leave taxpayers without clear guidance during critical periods such as tax deadlines or system outages.

| Problem | Consequences | Estimated Annual Cost |

|---|---|---|

| Billing inaccuracies | Overcharges and processing delays | Over $500,000 |

| System downtime | Missed filing deadlines | $200,000 in penalties |

| Poor customer support | Growing public dissatisfaction | Ongoing intangible costs |

Complex Challenges Hindering Revenue Collection and Administrative Effectiveness

Philadelphia’s tax collection framework is burdened by multifaceted challenges that diminish its efficiency and reliability. Outdated software systems struggle to process the increasing volume of transactions, while frequent staff shortages and inconsistent enforcement of tax policies exacerbate operational difficulties. These factors contribute to delays, errors, and disputes, leaving many taxpayers confused about their responsibilities. Additionally, poor interdepartmental communication further slows response times and results in lost revenue opportunities.

Underlying structural issues include:

- Opaque billing and penalty procedures: Taxpayers often receive unclear statements and ambiguous penalty notices.

- Disjointed data management: Multiple unintegrated systems cause duplication of records and missed assessments.

- Insufficient staff preparedness: Employees frequently lack the training needed to handle complex tax cases, increasing error rates.

| Challenge | Effect | Current Status |

|---|---|---|

| Legacy software | Frequent crashes and slow processing | Upgrade plans underway |

| High staff turnover | Knowledge loss and inconsistent enforcement | Attrition remains high |

| Unclear policies | Revenue leakage and disputes | Policy reviews ongoing |

Consequences for Philadelphia’s Residents and Business Community

The inefficiencies within the Department of Revenue have tangible negative effects on Philadelphia’s population. Many residents face delayed tax assessments, erroneous billing, and prolonged refund processing times, leading to unexpected financial burdens and increased stress. This uncertainty complicates personal budgeting and can adversely affect credit ratings. Homeowners and renters alike express frustration over the lack of clarity and fairness in their tax dealings.

Local businesses, particularly small and medium enterprises, are also impacted by these administrative shortcomings. Reliable tax processing and clear regulatory communication are vital for their financial planning and growth. However, errors and inconsistent messaging from the department force many companies to divert resources toward resolving tax issues rather than focusing on expansion. Key challenges include:

- Slow approval of tax credits and incentives

- Confusing payment notices leading to missed deadlines

- Frequent disputes due to inaccurate account information

| Issue | Impact |

|---|---|

| Refund processing delays | Cash flow disruptions for households and businesses |

| Misapplied payments | Unwarranted penalties and credit risks |

| Communication breakdowns | Increased disputes and overwhelmed customer service |

Essential Reforms to Enhance Accountability and Service Quality

The Philadelphia Department of Revenue’s current state of disarray and lack of transparency demands urgent corrective measures. Residents report difficulty obtaining timely responses, while inefficient tax processing and record management erode public confidence. To reverse this trend, the city must implement clear accountability frameworks and strengthen oversight through independent monitoring bodies. This should include comprehensive performance audits and transparent reporting on reform progress to ensure officials are held responsible for service failures.

Recommended actions include:

- Modernizing digital infrastructure to minimize processing delays and reduce errors;

- Ongoing staff development focused on compliance and customer service excellence;

- Active engagement with community stakeholders to gather feedback and foster continuous improvement;

- Creation of independent oversight committees to supervise departmental operations and reforms.

| Issue | Current Situation | Proposed Solution |

|---|---|---|

| Response delays | Average wait time of 3 weeks | Reduce to less than 5 days |

| Frequent system failures | Regular disruptions | Infrastructure upgrades |

| Lack of transparency | Infrequent and unclear reporting | Mandatory quarterly public disclosures |

Conclusion: A Call for Comprehensive Overhaul to Safeguard Philadelphia’s Fiscal Future

As Philadelphia confronts the persistent challenges within its Department of Revenue, the imperative for sweeping reform has never been more urgent. Tackling inefficiencies, enhancing transparency, and rebuilding public trust are critical to ensuring the department fulfills its mission effectively. Without decisive intervention, ongoing mismanagement threatens to further diminish confidence in this vital municipal agency, with significant repercussions for the city’s financial stability and the well-being of its communities.